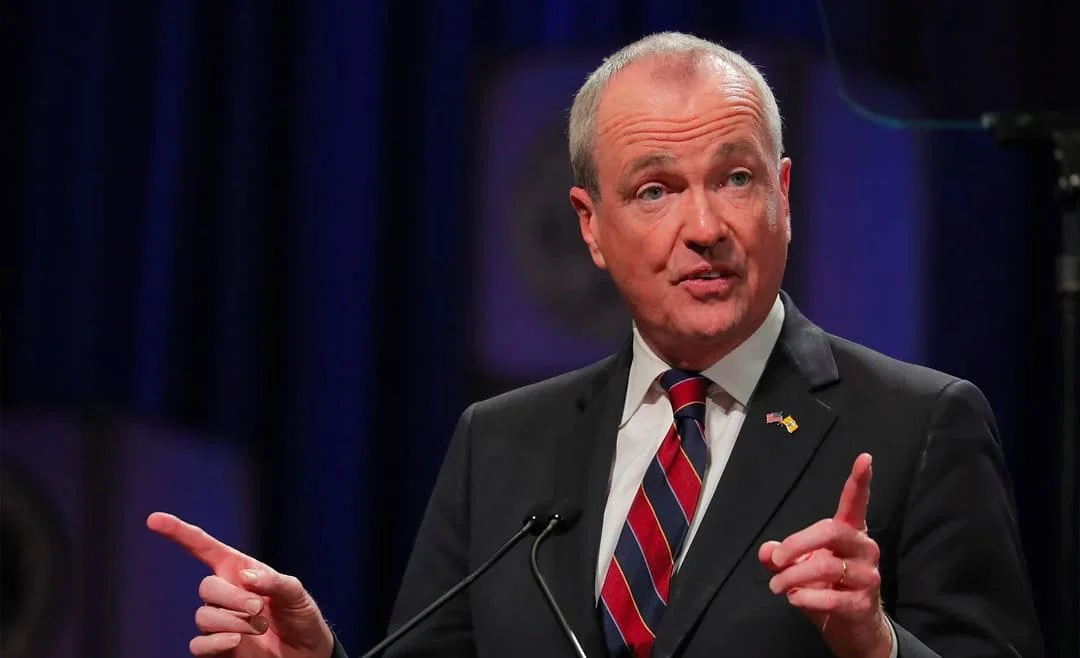

Gov. Murphy's Work Around Tax Law Is More Likely Federal Tax Evasion

The federal tax law change enacted for the 2018 tax year limits the combined total of state income tax plus real estate tax deduction to $10,000. “Goldman Sachs” Governor Phil Murphy of New Jersey has recently signed a bill which he calls a “work-around”, permitting the deduction of taxes in excess of $10,000 as a charitable contribution made to the municipality in which one lives. Rather than a “work-around”, it is more likely something else – an income tax evasion scheme.

The law Governor Murphy signed was created expressly to circumvent the new federal tax law – he even said so! The new law allows municipalities in New Jersey to create “charitable entities” for the purpose of receiving payments from homeowners whose combined state income tax plus real estate tax liabilities (beginning in 2018) exceed $10,000, the amount the new federal tax law places as a limit for their deductibility as itemized deductions.

Here's an example of how this might work: Mr. & Mrs. New Jersey Taxpayer own a home on which their 2018 real estate taxes are $9,000 and their New Jersey state income taxes are $5,000 – for a total of $14,000. Under prior federal tax law there was no problem, the total of $14,000 was deductible on Schedule A as itemized deductions ($5,000 for state taxes, $9,000 for real estate taxes). Not so under the new federal tax law for 2018, which permits the maximum deduction of only $10,000. Mr. & Mrs. NJ Taxpayer would be unable to deduct the remaining $4,000.

Governor Murphy's “work-around” would permit the deduction of the $5,000 state income tax plus $5,000 of the real estate tax ($10,000 total per the new federal law). Plus, it would allow Mr. & Mrs. Taxpayer to pay the remaining $4,000 to the “charitable entity” created by their municipality and to deduct this amount as a charitable contribution on Schedule A. What is wrong with this “work-around” signed into law by Governor Murphy? Let us look at the Internal Revenue Code sections for real estate taxes and charitable contributions for definitions.

IRC section 164 (Taxes) allows for the deduction of “state and local, and foreign, real property (real estate) taxes”. This is the definition of real estate taxes. Personal property taxes are defined as “an ad valorem tax which is imposed on an annual basis in respect of personal property” [IRC 164(b)(1)].

IRC section 170(c)(2)(A) & (B) (Charitable Contributions), states that the term “charitable contribution” means a contribution or gift to or for the use of – “A corporation, trust, or community chest, fund, or foundation – created or organized in the United States or in any possession thereof, or under the law of the United States, any state, the District of Columbia, or any possession of the United States; organized and operated exclusively for religious, charitable, scientific, literary, or educational purposes, or to foster national or international amateur sports competition, or for the prevention of cruelty to children or animals.”

Municipalities are not Charities

The “charitable entity” organized by a municipality will not function as any of the above charitable purposes. Its only function will be to receive payments from property owners and then pass those amounts to the municipality – which will treat the amounts received as payment of real estate taxes. This makes the law's permitted “charitable entities” appear to be bogus since they will not function in a charitable manner.

Another problematic aspect of this scheme is the consideration received for a charitable contribution. For example, a taxpayer who sends $100 to a charitable organization and receives a book from the organization valued at $30 is only allowed to deduct $70 as a charitable contribution ($100 paid less the $30 value of the book received). How might that apply in the case where NJ homeowners “contribute” an amount to a “charitable entity” organized by a municipality in this “work-around” situation? Let's use the prior example of Mr. & Mrs. Taxpayer where $4,000 was “contributed” to a “charitable entity” organized by a municipality to receive excess real estate taxes as charitable contributions. How will that entity determine how much benefit Mr. & Mrs. Taxpayer received from the municipality in services provided to the taxpayers such as: public schools/education, the police force, road maintenance, garbage collection and other municipal services? Would the “charitable entity” attempt to make such a calculation? Probably not, because that might reduce the deductible amount of the “charitable contribution” considerably – most likely all the way to zero! Mr. & Mrs. Taxpayer would not be happy with Governor Murphy's work-around.

Another consideration is the percentage limitation of the taxpayer's contribution base for certain charitable contributions per IRC section 170(b)(1), Individuals. Most contributions may not exceed 50% of the taxpayer's contribution base, and some are limited to 30% of the contribution base. This would likely apply to wealthy taxpayers with considerable assets and little or no income, which might be the case of a retired taxpayer. If such a taxpayer owned 2 or more expensive residential properties in New Jersey, the deductible portion of the amount paid to municipal “charitable entities” could be reduced considerably – maybe to zero by this percentage limitation of the Internal Revenue Code.

It appears that Governor Murphy's law permitting municipalities to organize their “charitable entities” will run afoul of the IRS' rules and regulations, which could subject the municipalities to penalties for knowingly creating bogus “charitable entities”. Additionally, if the residents of the municipalities who take advantage of Governor Murphy's “work-around” were to be audited by the IRS, they could be subject to the accuracy-related penalty as provided under IRC section 6662 for any audit deficiency caused by the disallowance of the bogus charitable contribution deductions paid to the entities. In an extreme case, the IRS might consider the application of the civil fraud penalty described in IRC section 6663.

For the reasons listed above, taxpayers should exercise caution in the matter of making payments to “charitable entities” organized by their municipalities. Municipalities should also be cautious about organizing any “charitable entities” which could possibly end up being deemed bogus.

These are serious issues of potential fraud and illegality that the Murphy administration is encouraging the NJ taxpayer to use to reduce their tax burden. In reality, it will be the individual New Jersey Taxpayer that will pay the price for this scheme, not “Goldman Sachs” Governor Phil Murphy!

The above are opinions, comments and analyses of the “work-around” bill recently signed into law by “Goldman Sachs” Governor Phil Murphy of New Jersey. The contributors are a retired Internal Revenue Service field agent and a current Certified Public Accountant in New Jersey.